US Drug Test Centers Research Articles

Passing the Test

To paraphrase American author Mark Twain: Rumors of the death of the traditional workplace have been greatly exaggerated. Despite the impact of the COVID-19 pandemic on the use of work-from-home setups, the majority of jobs in the U.S. can't be done remotely. But until (and after) vaccine distribution is complete, there will be a huge need to continue and even expand COVID-19 testing at home/work.

As 2020 ended, the U.S. jobless rate stood at 6.7%[1], which in normal times wouldn't be anything to celebrate. However, considering that it peaked at nearly 15% in April 2020 after deep pandemic-related job losses, the end of the year was cause for celebration for more reasons than one.

However, without expansion of testing for the virus, millions of jobs could be at risk. The good news is that vaccine access is expanding, and the US has led the way in terms of the number of tests purchased [2]. Considering the sheer number of jobs we're talking about, the data suggests that companies would be wise to invest in gold standard PCR testing at-home/work.

As COVID-19 wreaks havoc on businesses, the cost of not implementing workplace testing will far exceed the cost to test. With new variants popping up, it is possible that COVID-19 will be here longer than we would like, and it is critical for businesses to test in order to maximize their productivity in the short and long term.

It's important to remember that vaccines, testing, social distancing and mask-wearing, among other precautions, are all part of a landscape of safety, and that the result of one test doesn't necessarily mean a person is in the clear.

Still, we wanted to understand just how much of an issue this could be and how many jobs might be at stake if industries where remote work is a challenge focused on ensuring employees were virus-free by providing testing. Even when more people have been vaccinated, continued testing will be necessary, as efficacy rates vary, and the two types of vaccines approved so far in the U.S. have not yet been evaluated for their ability to prevent spread but rather to prevent illness. [3]

To create our analysis, we examined employment figures released by the U.S. Bureau of Labor Statistics covering jobs by industry sector in December 2019 and December 2020 as well as an analysis by the BLS about the percentage of jobs per sector that can't be done remotely.

Read on for our full study, and check out the key highlights below:

- More than 95 million Americans work in industries where they have a lower-than-average chance of being able to work remotely; that equates to more than 60% of workers in a typical year.

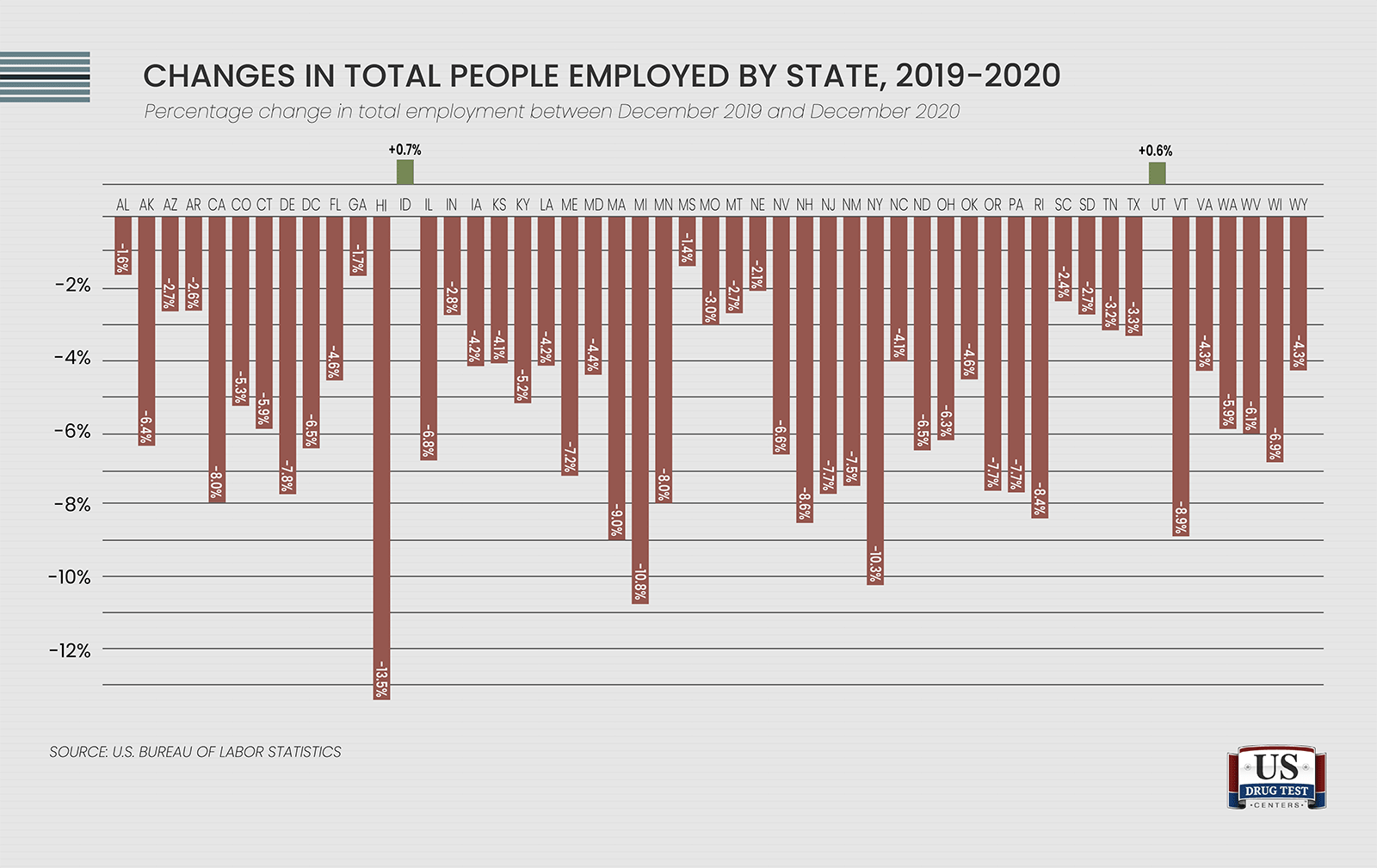

- Hawaii, New York and Michigan all saw employment fall by double digits between 2019 and 2020.

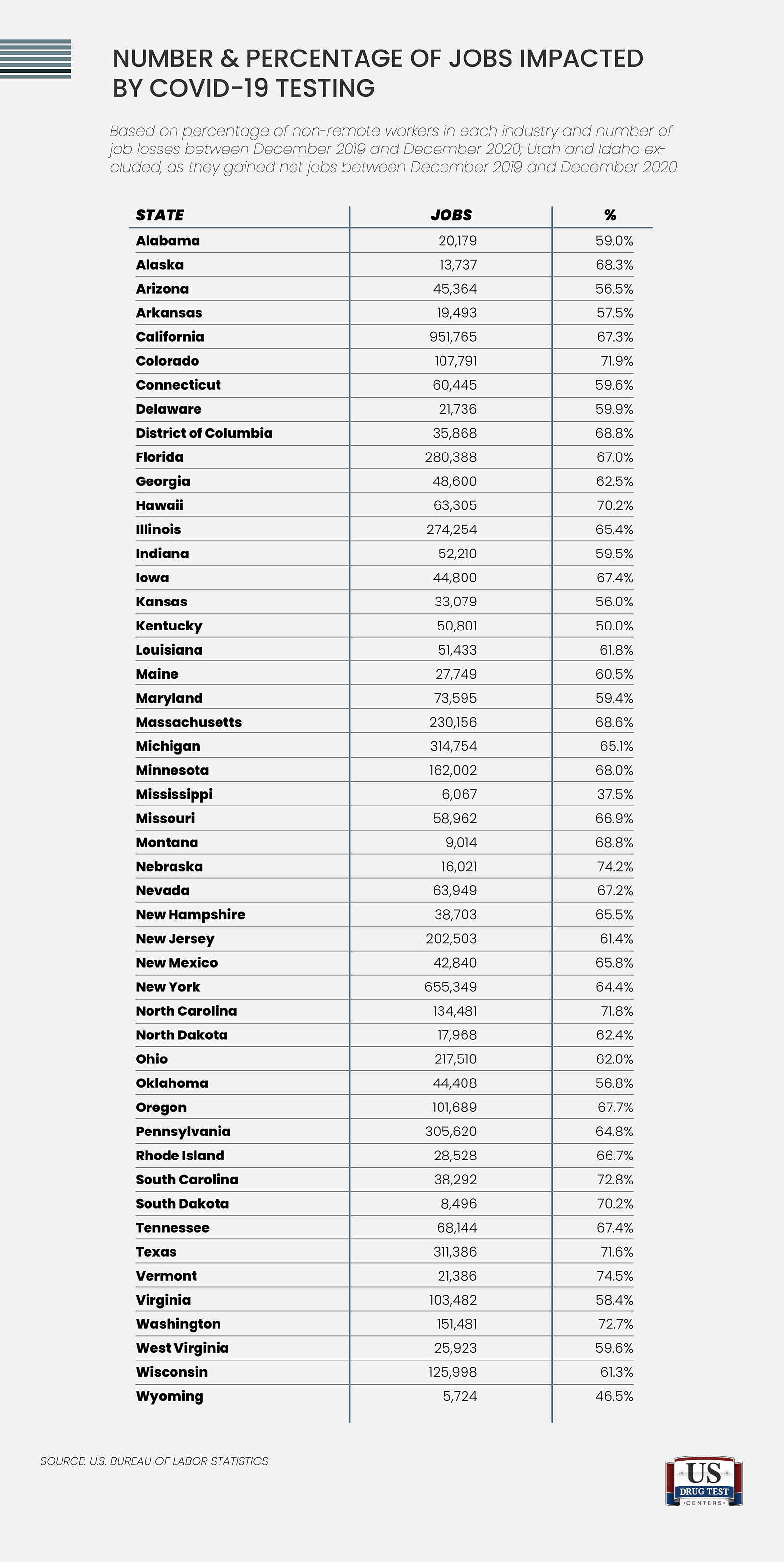

- About three-quarters of 2020 job losses in Vermont could be erased by widespread use of COVID-19 testing based on the percentage of workers in each industry that can't work from home. That's the highest rate in the country, followed by Nebraska (74.2%) and South Carolina (72.8%).

A New Normal? Not So Fast

All types of workplaces, from factories to offices to schools to construction sites, will need to consider using at-work COVID-19 tests. Even industries in which remote work is more common, it's unlikely that many companies will move to an entirely work-from-home setup; only about 20% of executives in a PwC survey said they expected to return to pre-pandemic arrangements entirely. [4] That means these organizations must create a safe place for workers on days when they'll be in the office.

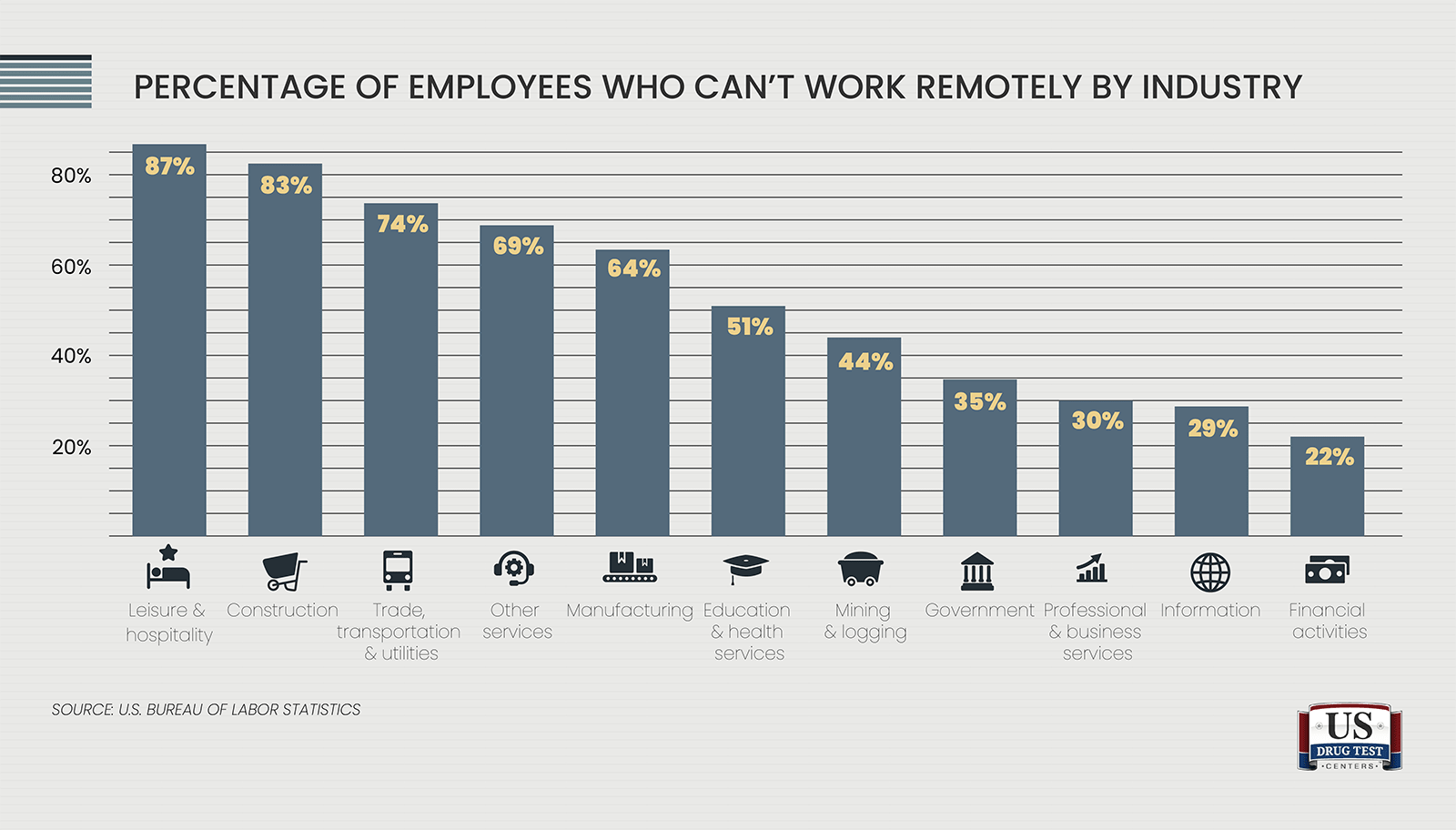

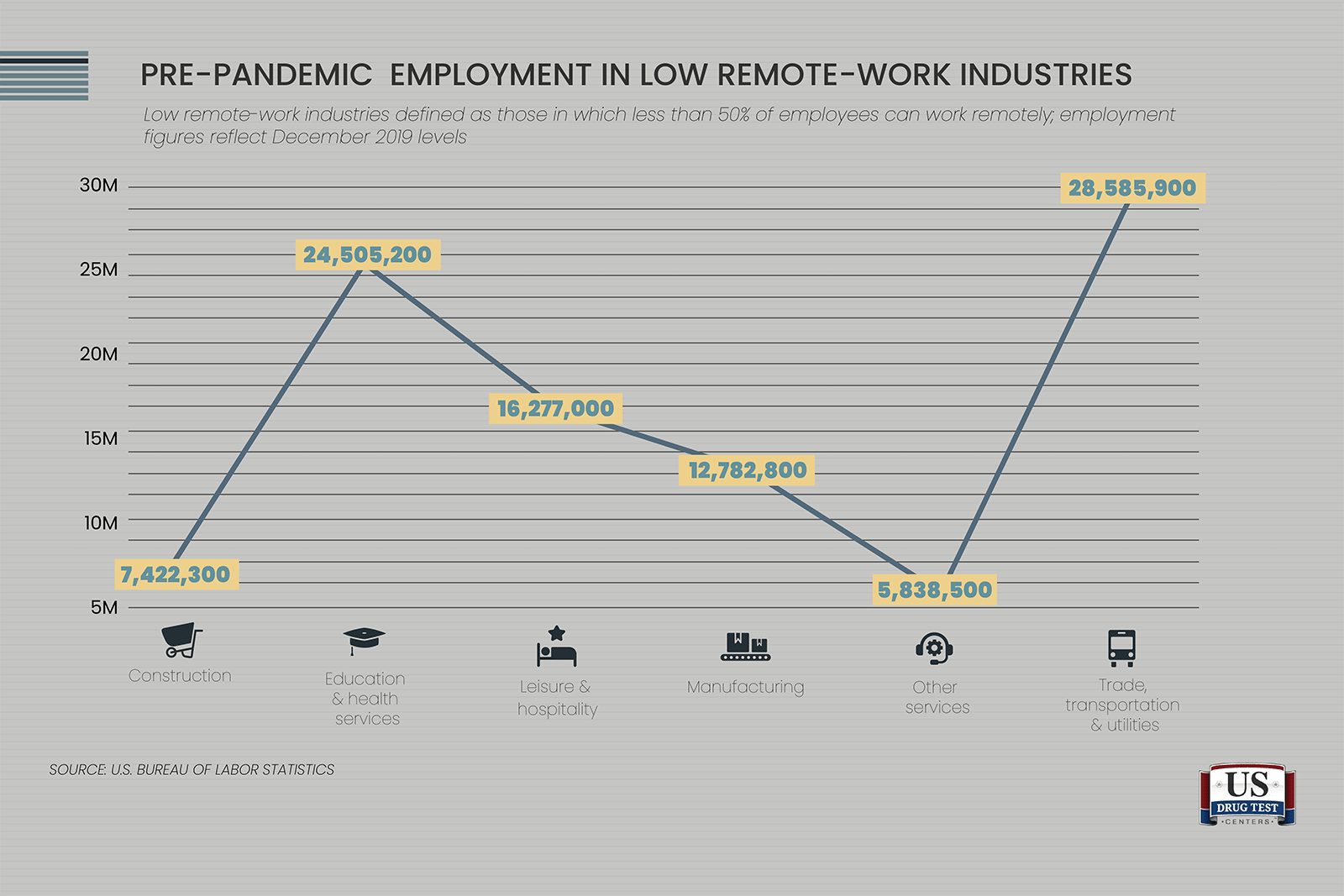

And after all, there are millions of jobs that simply cannot be done on a remote basis. In fact, according to a BLS analysis, few jobs in leisure and hospitality, construction or trade, transportation and utilities can be done on a remote basis. [5] For other sectors, the opposite is true; only about 1 in 5 financial activities workers can't do their jobs remotely.

How does that translate into jobs? Outside of agriculture, which employs about 3 million Americans, almost two-thirds of jobs are in industries where remote work is uncommon, though it's important to note that not every individual in those sectors is limited in their ability to work from home. Still at the end of 2019, a combined 95.4 million Americans worked in industries where employees are more likely than not to be able to do their jobs remotely.

Where Jobs Were Lost

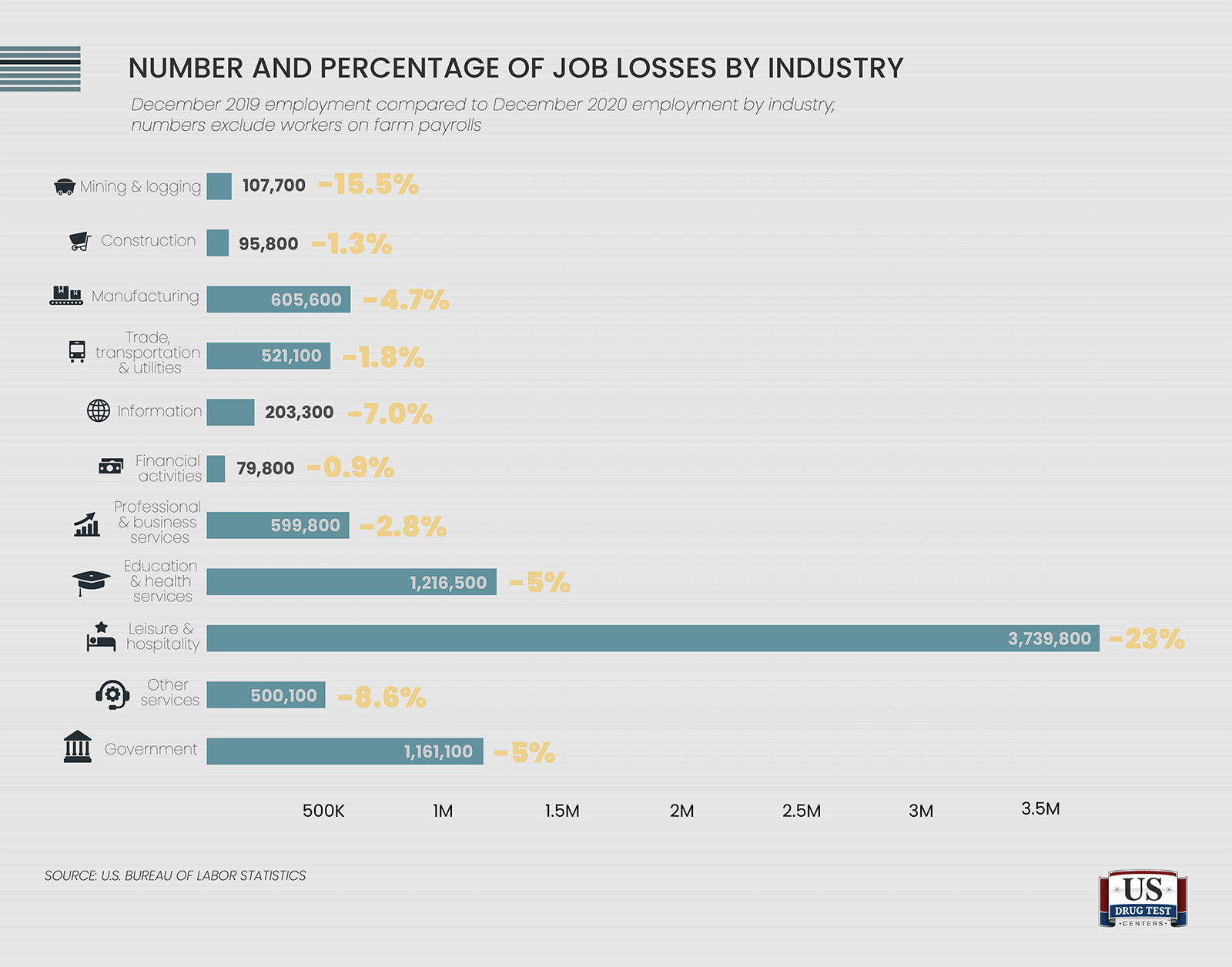

Nearly 9 million jobs vanished between December 2019 and December 2020, while not all cuts were pandemic-related, there's little doubt that the virus has decimated many employers. Which industries suffered the most?

All major industry sectors ended 2020 with lower levels of employment than in 2019, but the hospitality sector, which includes restaurants, hotels and similar establishments, recorded both the highest number and percentage of job cuts.

Focusing on geographic differences, all but two states experienced a net job loss between 2019 and 2020. The two holdouts were Idaho and Utah, which each saw total employment rise very slightly - less than a percentage point - as losses in some industries were offset by gains in others. Compared to pre-pandemic employment numbers, the crisis was the worst in Hawaii, Michigan and New York, which all posted double-digit job declines.

Where COVID-19 Testing Might Have the Biggest Impact

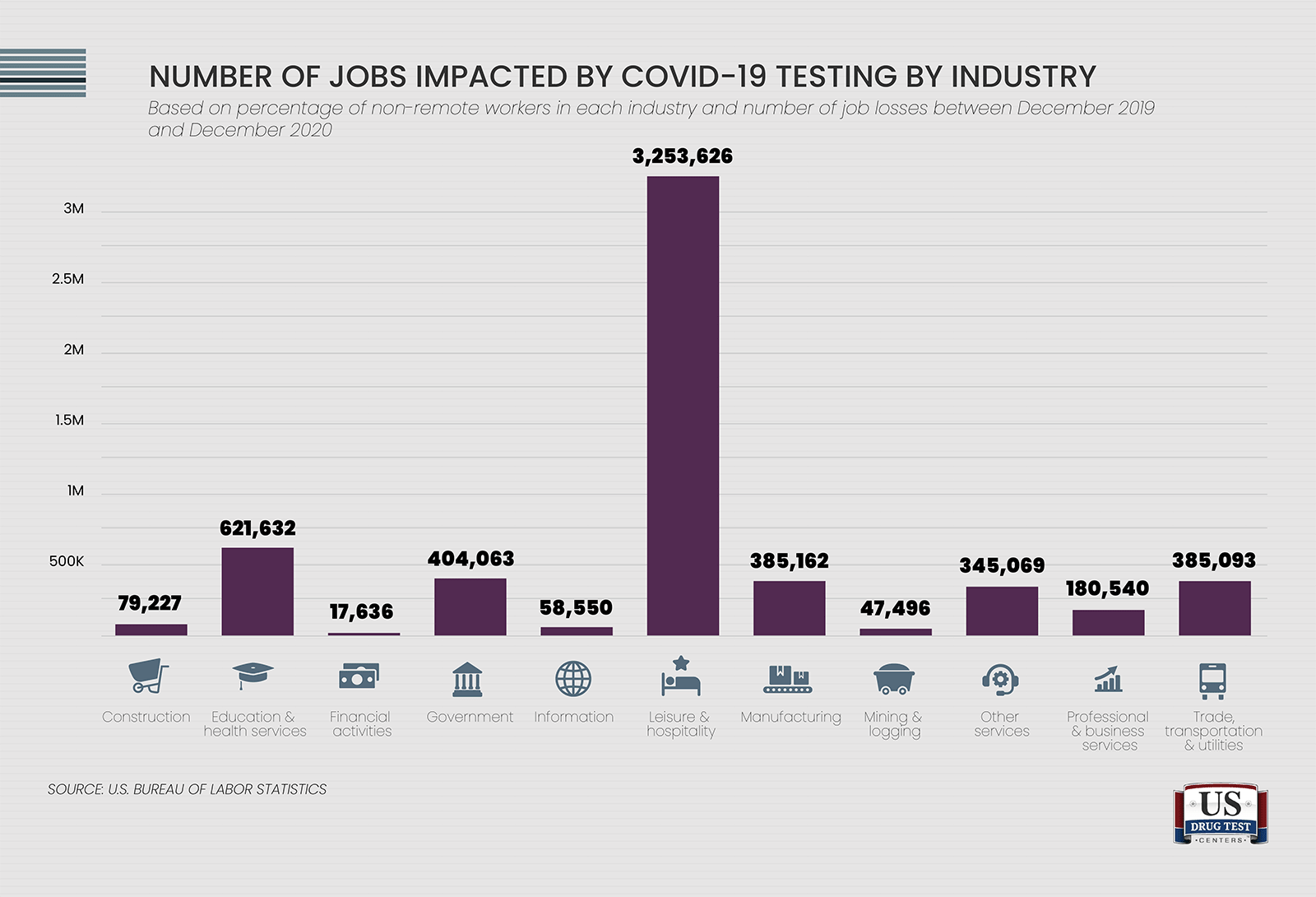

The use of regular at-home or at-work COVID-19 testing is one option for employers who want to bring workers back to the workplace safely. By sheer volume, the number of jobs potentially at stake is staggering. Based on the percentage of workers in each industry who previously were unable to work remotely, we estimate that up to 5.8 million jobs could be dependent on the use of COVID-19 testing, administered at home or at the workplace.

One industry stands far ahead of the rest; in fact, the leisure and hospitality industry stands to regain about five times more jobs than the next-highest industry.

States are poised to vary dramatically in their expected recovery based on which industries are most dominant, but testing could help the average state regain an average of about 64% of the jobs that disappeared between 2019 and 2020.

Testing would be most impactful in Vermont, where about 75% of job losses could be erased based on the estimated percentage of employees per industry who can't work from home. That's followed by Nebraska (74.2%) and South Carolina (72.8%). Excluding Idaho and Utah, which posted net job increases, only about 46.5% of jobs in Wyoming that disappeared in 2020 look to be impacted by wider at-home testing.

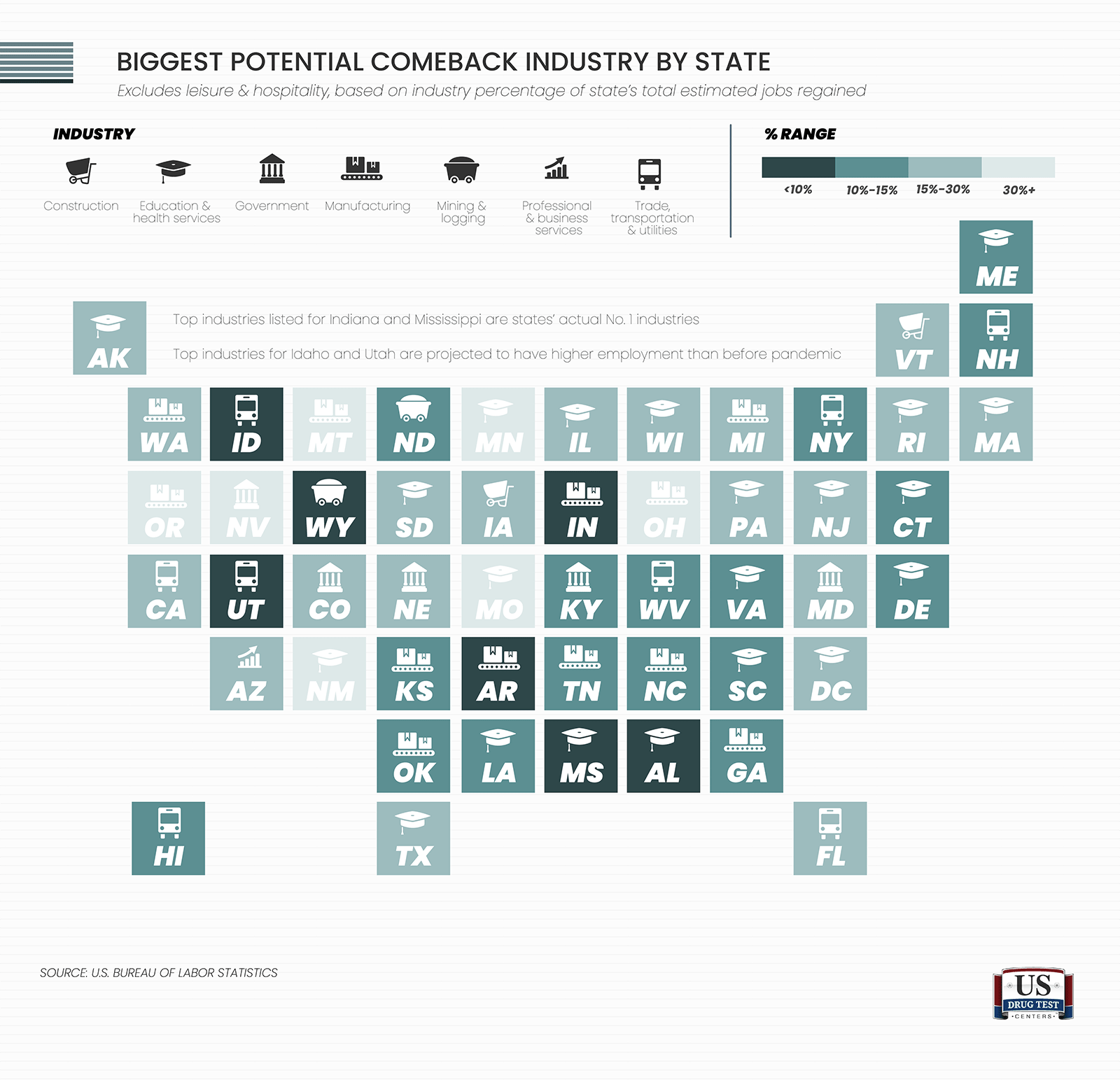

In all but two states that posted overall job losses between December 2019 and December 2020, the greatest potential for gains is in the leisure and hospitality sector. In fact, about 60% of all estimated jobs that could be regained with widespread employer-provided COVID-19 testing are in leisure and hospitality, followed by education and health services, where about 12 percent of those jobs are located.

For about 20 states, education and health services is the industry with the second-highest percentage of jobs poised to return with widespread take-home COVID-19 testing, but there are several notable exceptions.

In Indiana, manufacturing accounted for the highest percentage of potential job recovery (44.6%) thanks to at-work testing, while about three in testing-impacted jobs in Mississippi are in education and health services. For Idaho and Utah, both of which gained jobs over the course of the year, the trade, transportation and utilities sector was most responsible for the increase. Both states had more jobs in this sector than they started the year with, while Utah also had a net increase in construction.

Conclusion

While COVID-19 testing isn't a silver bullet, if workers are to return to the workplace safely without unreasonably contributing to the risk of spreading the virus, surely it's a small price for companies to pay. With millions of jobs at stake, perhaps it's a question of whether they can afford not to include testing as a key safety measure.

Methodology

As we mentioned, our analysis was based on the final jobs report for 2020 released by the U.S. Bureau of Labor Statistics as well as a BLS analysis of the percentage of workers in each industry who can or cannot work remotely. In that analysis, two estimation methods are referenced, and for our study, we used the results based on the American Time Use Survey (ATUS). We felt this would better capture employees who have the ability to work from home rather than those who always or frequently do.

Finally, in some states, certain industries actually saw an increase in employment when comparing December 2019 to December 2020, and these gains were factored into each state's net total for the year.

[1] https://www.bls.gov/news.release/pdf/empsit.pdf

[2] https://sitn.hms.harvard.edu/flash/2020/covid-19-testing/

[3] https://www.cdc.gov/coronavirus/2019-ncov/vaccines/facts.html

[4] https://www.pwc.com/us/en/library/covid-19/us-remote-work-survey.html

[5] https://www.bls.gov/opub/mlr/2020/article/ability-to-work-from-home.htm